Foreign investors should develop a Hainan investment strategy to take advantage of tax cuts, access to ASEAN, and RCEP.

Op/Ed by Chris Devonshire-Ellis

- Tax incentives kick in for foreign investors from January 2021

- Entire island is to become a Free Trade Port

- Being positioned as an alternative Singapore

- Huge opportunities in medical tourism

- Free trade agreements with ASEAN & RCEP

- Horse racing, golf clubs, and attractive climate

- Branch offices of Hainan WFOEs can operate throughout China

Slightly flying under the radar in terms of its attractiveness to foreign investors has been Hainan Island, off the southern China coast of Guangdong province and near the eastern coast of Vietnam. However, as costs in primary cities like Beijing and Shanghai increase, the need for a less expensive destination, with warmer weather, outdoors sub-tropical climate and with little heavy industry pollution begins to appear more attractive. However, Hainan has an inherent problem – its perception as a low-end Chinese tourist destination, sometimes touted as ‘China’s Hawaii’. (It is not).

Although beach resorts, such as Sanya, do attract Chinese tourists in their millions – Hainan Airlines has China’s longest internal flight, servicing tourists in search of winter sun from Harbin – the regional government has been looking at ways to diversify from this staple and into other business and trade areas. These will be of interest to any CEO of a foreign-invested enterprise in China, and to China investors themselves.

Hainan Free Trade Zone

We first reported back in April 2018 that the entire Island was to become a free trade zone (FTZ).

According to guidance issued by the State Council, China announced plans to establish the Hainan FTZ by 2020 and build Hainan Free Trade Port by 2025. By 2035, Hainan’s free trade system should be fully developed. Well, we are in 2020 now and what has happened?

At the beginning of June this year, the Central Committee and the State Council jointly released the Hainan Masterplan, which laid out a series of special policies for Hainan – scrapping import duties, lowering income tax rates for high-level talent, capping company tax at 15 percent for encouraged enterprises, and relaxing visa requirements for tourist and business travelers. These will take effect in six weeks – from January 1, 2021.

Collectively, the policies are designed to diversify Hainan’s reliance on traditional industries and to function as a strategic trade and investment destination in China. For foreign firms, Hainan will provide broader market access – particularly for industries like telecommunications, tourism, and education – in addition to a phased plan for capital account opening and free flow of money between Hainan and overseas markets.

Hainan Free Trade Port

In addition to the free trade status of the Island, China is also positioning the entire island as a strategic free trade port, meaning developments in several port locations are being ramped up, including the Hainan’s capital, Haikou. That will position Hainan as a major duty-free shopping hub and offer facilities for consolidation of component products being brought in for additional work and assembly from ASEAN and beyond. China already has a free trade agreement with ASEAN, meaning duty free movement of most goods. Vietnam, for example, offers lower production costs than China and its main Ho Chi Minh City Port is just 725 nautical miles, or three-days shipping away. Vietnam, in turn, is connected to landlocked Cambodia and Laos where basic manufacturing costs are lower still. Myanmar, with its low-cost workforce of about 25 million is also nearby. As many readers will know, China last week signed off the RCEP free trade agreement, which also includes Australia, Japan, New Zealand, and South Korea. Companies from these countries will be setting up factories in Hainan to take advantage.

Medical tourism

China has been eying the medical tourism industry for some time, and Hainan is perfectly positioned to become a wellness centre with detox, spa resorts, therapy as well as plastic, cosmetic, and reconstructive surgery. We discussed Hainan’s Medical Tourism Zone plans here. However, it is also positioning itself to cater for serious diseases, such as cancer with treatments not available elsewhere in China. The Boao Lecheng International Medical Tourism Pilot Zone in Hainan has launched a special drug insurance that covers 70 anti-cancer drugs, including 49 medicines not yet approved for sale anywhere else in China. We discussed this here. Qualified foreign doctors and nursing professionals will also be encouraged to live and work in Hainan while the Island’s duty free status and medical tourism zone plan combine to allow importation of medical equipment, and drugs that may not otherwise be easily available. With mainland China’s massive population on the doorstep, the opportunities are huge.

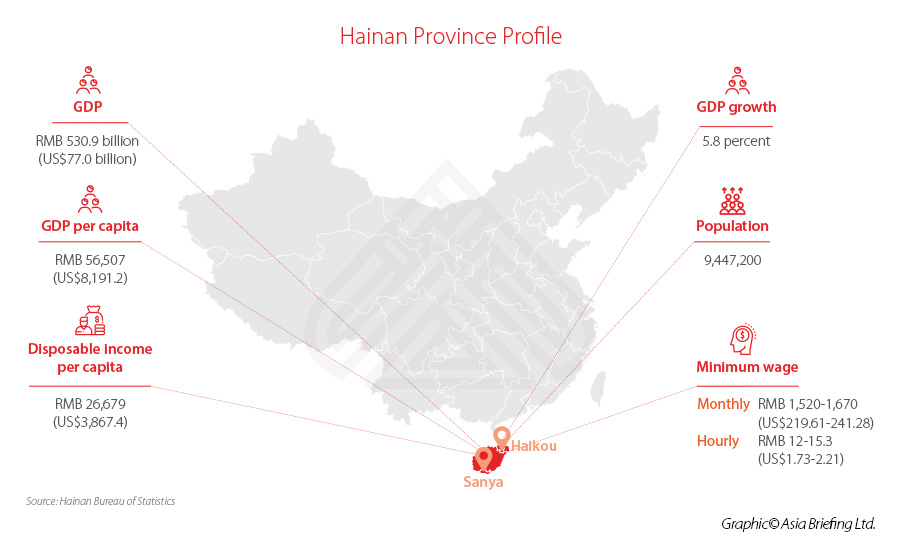

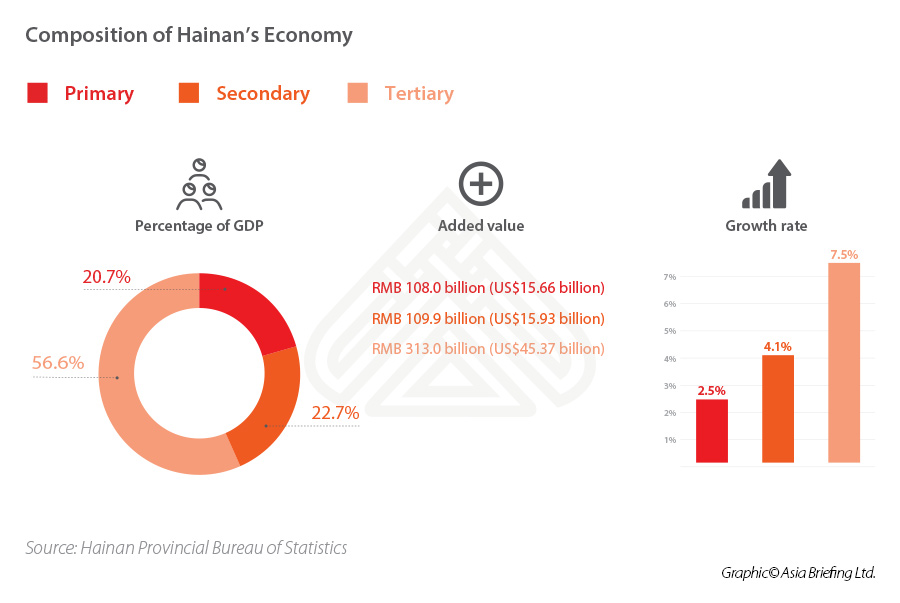

Hainan’s local economy

Hainan’s economy has a small industrial sector and leans heavily towards resource extraction and services. In 2019, its primary industry constituted 20.3 percent of GDP – the highest among any Chinese province – while its secondary industry accounted for only 20.7 percent, which is less than half that of most other provinces. Resources that contribute to its sizable primary industry include the extraction of products, such as seafood, tropical fruit, tea, and rubber, while its tertiary sector is strongly linked to the tourism industry.

Much of Hainan’s secondary industry, meanwhile, is associated with the processing of petroleum and other natural resources like rubber, as well as transport equipment and pharmaceuticals, among others.

Expat attractions

Golf

Please see a map of the current locations of golf courses in Hainan.

Horse racing

Horse racing

China will permit horse racing on mainland China for the first time, while limited forms of gambling – namely betting and sports lotteries – will be permitted in Hainan. Hong Kong and Macao are currently the only jurisdictions in China that allow horse racing and Macao is the only one to permit casinos and gambling. The latter are not yet on the agenda for Hainan, but it cannot be far behind.

Hainan as China HQ for expat CEOs

In addition to the increasingly attractive lifestyle, foreign investors, especially those in the services industries, may establish wholly foreign owned enterprises in Hainan to take advantage of the 15 percent corporate income tax rate. Although duty will be payable on various goods from Hainan exported to mainland China, services are a different matter and especially when combined with sound tax planning.

WFOEs may establish branch offices in China, meaning a Hainan-based business can take advantage of the lower tax rate and lifestyle while still developing a network across China.

Additionally, a WFOE owned by a nearby Hong Kong or Singapore holding company will find it easy, via that entity, to establish subsidiaries elsewhere, such as in Vietnam or other ASEAN countries.

No comments:

Post a Comment